Investor Jennie shares her experience with Lendahand:

Investor Jennie shares her experience with Lendahand:

In January 2020, I mentioned that I had started investing in crowdfunding projects through Lendahand. A year has now passed, and I can share more about how I’m finding it and what it has brought me so far.

What is Lendahand and how did I get started?

Let me start by briefly explaining what Lendahand is precisely and how I got involved. I came across Lendahand through my sister. She told me that she had been lending money to projects in developing countries through Lendahand for some time and that she would get it back later, with a bit of extra money (interest) as a thank you. I wanted that too! At the time, I was exploring the world of investing and was excited to see that this was also an option where I could do something good with my money. I signed up and eagerly put some initial euros into projects.

With Lendahand, you can choose which projects by entrepreneurs in developing countries you want to invest in. The website clearly describes each project’s goal (for example: installing solar panels or creating jobs), how much money is needed, the duration, and how much interest you’ll receive as a thank you if you decide to support the project. Every six months, you get a portion of the amount you lent repaid, with interest added. For a project that lasts 24 months, you’ll receive payments on four occasions. Below, you can see two projects I invested in.

For this project, €26,550 was raised to help 66 women in developing countries expand their businesses. I invested €50 in this project. In May 2021, I’ll get the amount back, with €3.62 interest as a thank you. It was a small investment but one with a high return, namely 7.25%.

In this project, I invested a larger amount, namely €250. The goal of this project was to purchase equipment for businesses in South Africa so that they would no longer suffer from power outages. Above, you can see that I already received a portion back in August, with €6.88 interest added. The remaining payment dates and the amounts I’m still due are also shown.

How much have I invested, and what has it brought me?

I invested money in Lendahand projects in January, February, March, and April of 2020. After that, I took a break because I bought my cabin and no longer had the financial space to invest in projects. I wanted to refill my savings account first and set aside money for renovations. Now that I’ve saved up again, there’s slowly some room to invest in projects. If you also want to start investing through Lendahand, I’d advise you only to use money you don’t need. It’s helpful to make a deal with yourself: I can only invest in projects if I have amount X [fill in yourself] in my savings account. This way, you can enjoy it for yourself and avoid money problems. Participating in these kinds of projects and earning returns is a bonus and shouldn’t be a primary source of income.

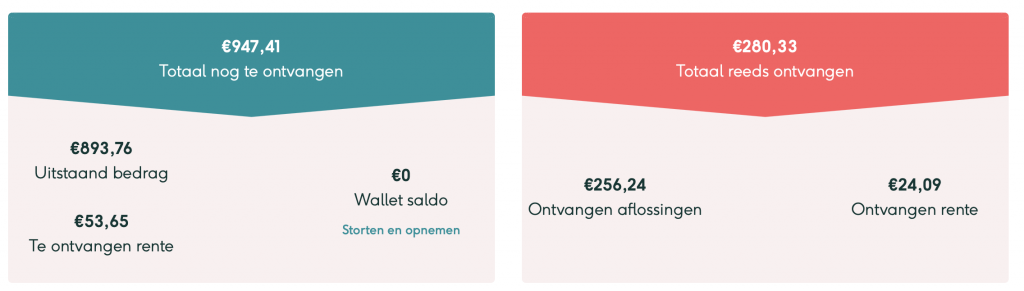

In total, I have invested €1,150 in Lendahand projects so far. On the right, you can see that I’ve already received €256.24 back, with €24.09 in interest added. On the left, you can see that I’m still due to receive €893.76 back in the future, with €53.65 in interest added. That’s a nice amount!

Update March 2022: it’s still going well! I received all my payments for 2021 as expected. From the above investments, I have now received €961.11 (including €68.89 interest) back and still have €352.37 (including €24.03 interest) left to receive in the coming months. So far, everything has gone smoothly as it should have! I’m very satisfied.

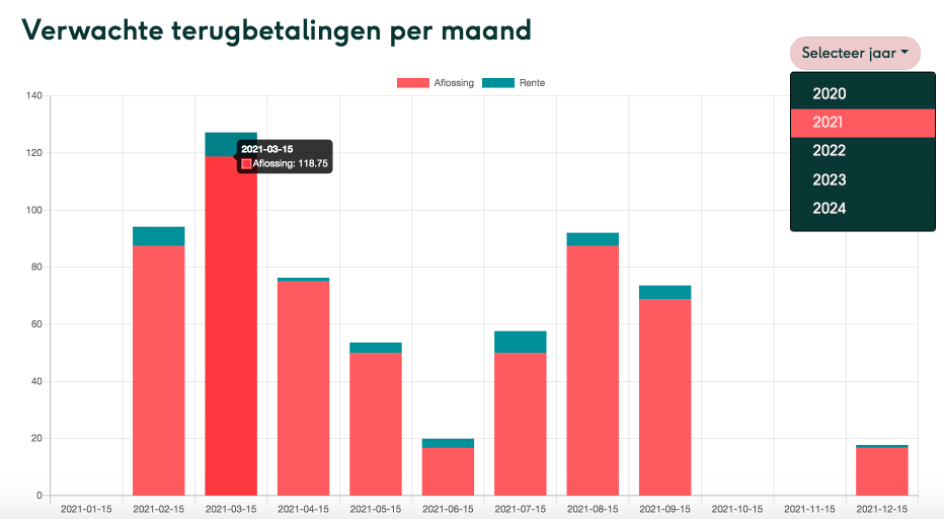

Lendahand has a dashboard where I can clearly see when I’ll receive which amounts back. 2021 is going to be a fun year, as I’ll get a nice amount back almost every month, with interest added. And then... the trick is to reinvest the amount I get back + the interest in new projects so that I can earn returns on that again. This way, you can make your money grow.

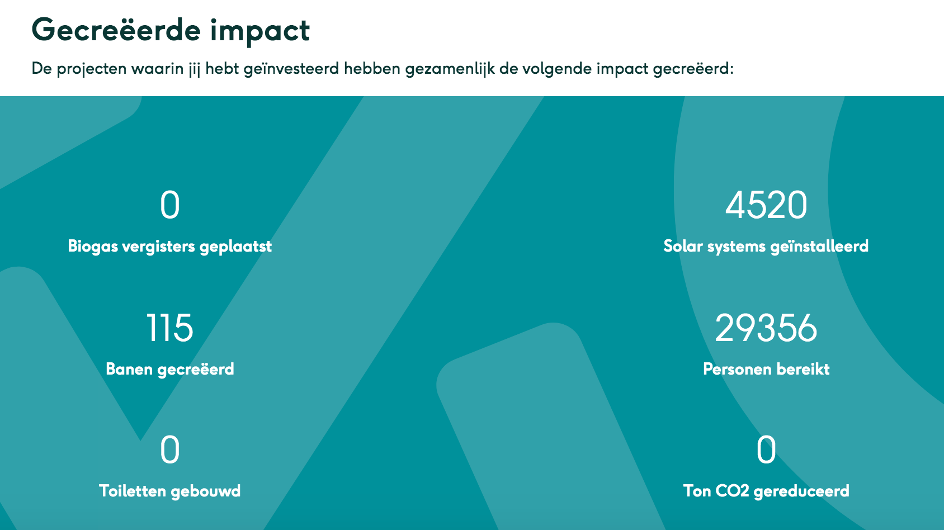

On the dashboard, I can also see what impact lending my money has had. Nice to see! I like that the projects have a sustainable focus, such as installing solar panels, making farms more sustainable, helping start-up local entrepreneurs, and creating jobs.

Whether I find it nerve-wracking to participate in these kinds of projects

Following my blog post in January 2020, in which I mentioned starting with Lendahand, I was often asked whether I find it nerve-wracking to invest my money in this. My answer to that is no. As explained above, I only put money that I have left over, besides my savings, into these projects. My sister had been using Lendahand for some time before I started, which gave me a sense of trust. Additionally, Lendahand is a BCorp certified company and won the IEX Best Crowdfunding Platform award in both 2018 and 2019. Although that all sounds good, there is always a chance of losing money with investing and crowdfunding. In the seven years that Lendahand has been around, more than 2,800 projects have been done, and only one has gone bankrupt. So the chance is small, but the risk is there. It’s advisable to spread your money across different projects and not put everything into 1 or 2 projects to spread the risk. I haven’t lost any money with Lendahand so far.

Disclaimers – I am not a financial expert and am only sharing my personal experience with Lendahand in this post. When investing through crowdfunding, there is a chance you may lose your investment. On the Lendahand website, you can find more information about the risks. This post is not sponsored but written on my own initiative.