The keys to impact investing in Europe in 2022

We present the conclusions of the "Accelerating Impact" report by EVPA and GSG, the first exercise in sizing the impact investing sector in Europe.

Whether you are an impact investor or a social entrepreneur, you have likely searched for data on the impact investing market in Europe more than once. However, finding this information is not an easy task: there are still few reliable sources that offer aggregated data on impact investing in European territory. One of them is EVPA (European Venture Philanthropy Association), a non-profit organization dedicated to promoting impact investing and venture philanthropy in our continent (and of which we are members!). EVPA conducts research, creates synergies within the ecosystem, and carries out dissemination activities such as events, talks, workshops...

EVPA has just published the report we have all been waiting for: "Accelerating Impact" is the first exercise in sizing the impact investing sector in Europe, conducted together with the Global Steering Group for Impact Investment (GSG). A comprehensive study that seeks to shed light on the state of impact investing in Europe as a whole, in which 285 organizations participated, representing 512 impact investment vehicles from 18 European countries.

Want to know their conclusions? Here is a summary:

1. The market size continues to increase but still represents a tiny percentage of the total investment

In 2021, the size of impact investing in Europe was 80 billion euros, representing a 26% increase compared to 2020. However, this only accounts for 0.5% of the investment market in Europe.

Of this total, 32 billion had some form of additionality. In impact investing, additionality refers to the real difference that the investment makes. That is, it is a concept that helps us consider whether the investment was decisive in achieving the impact, or if, on the contrary, the effect would have occurred in the same way through other means.

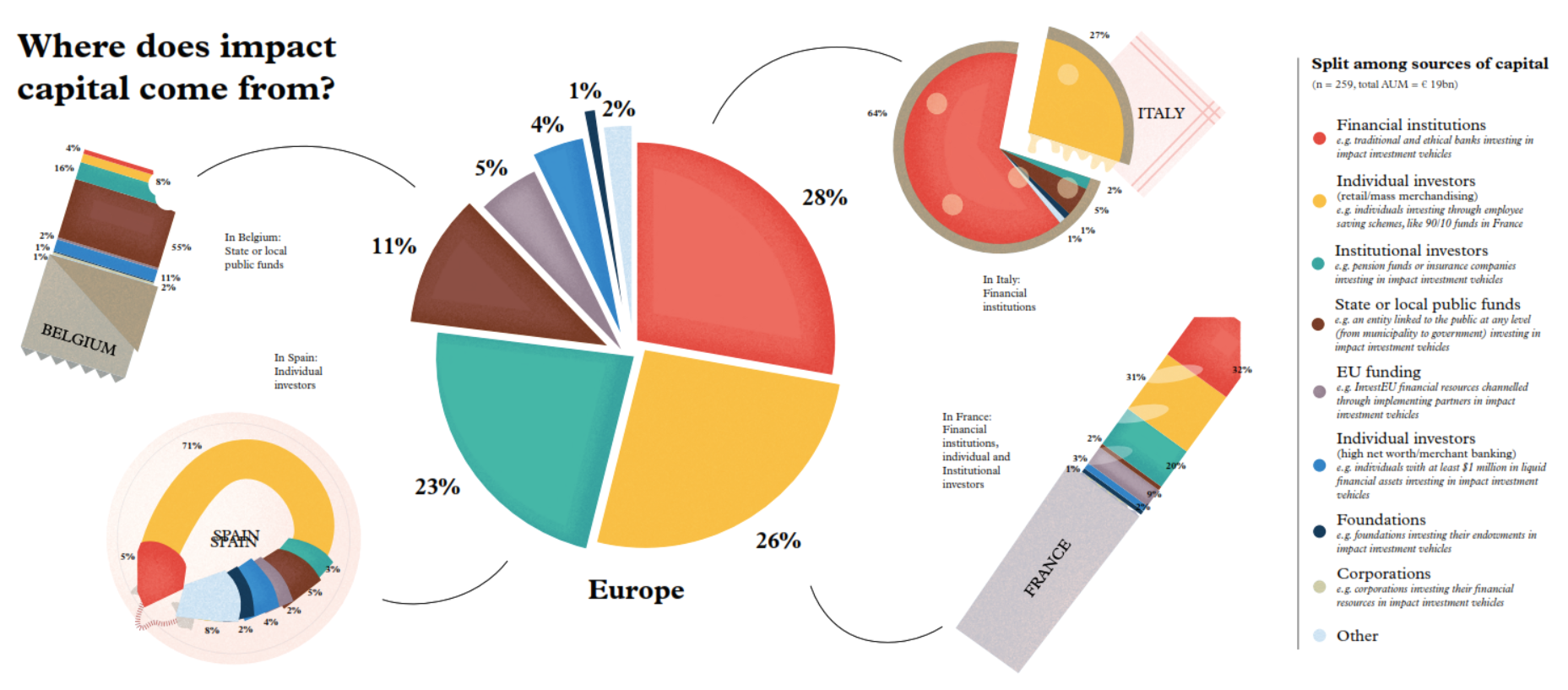

2. Most of the invested capital comes from individual investors, financial institutions, and institutional investors

The following chart shows where the investments come from, both in Europe and in several countries such as Belgium, Spain, Italy, or France. Generally, the total investments mainly come from individual investors (71% in Spain), institutional investors, and financial institutions.

This increase in individual investors is explained by favourable regulatory changes in some countries, such as the implementation of the 90/10 solidarity funds in France.

Among other actors, the tiny 1% from foundations is surprising. This may be because foundations are entities with very defined and established investment strategies and do not have the flexibility of other organizations to make changes. However, this figure also reflects the enormous untapped potential of foundations to advance their respective missions through impact investing.

It is also important to note the 5% coming from European funds, which has grown considerably from 1% in 2020; and the 4% from high net worth individuals. All of these are actors with great potential to make impact investments in the future.

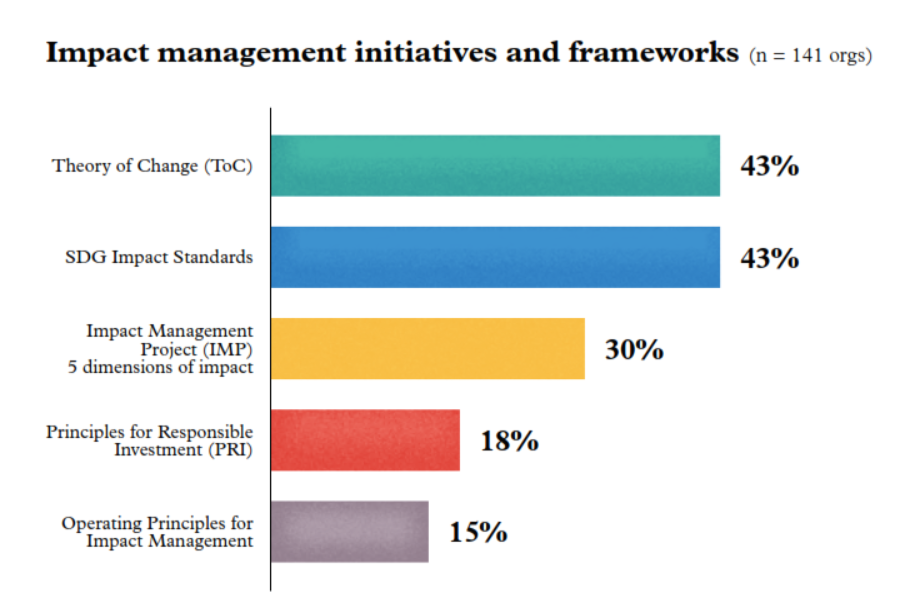

3. Theory of Change and SDG Impact Standards, the most used impact measurement methodologies

Regarding impact measurement, the Theory of Change and the SDG Impact Standards tied as leaders with 43%, followed by the 5 dimensions of impact from the Impact Management Project (IMP).

However, there is still work to be done in this area: despite all surveyed entities claiming to use some measurement methodology, 17% admitted not going beyond measurement to impact management activities.

At Lendahand, we use both the Theory of Change and the SDG standards. Check out our impact measurement and management framework to see in detail how we do it. You can also visit our impact page for a more summarized view of how we approach impact at Lendahand.

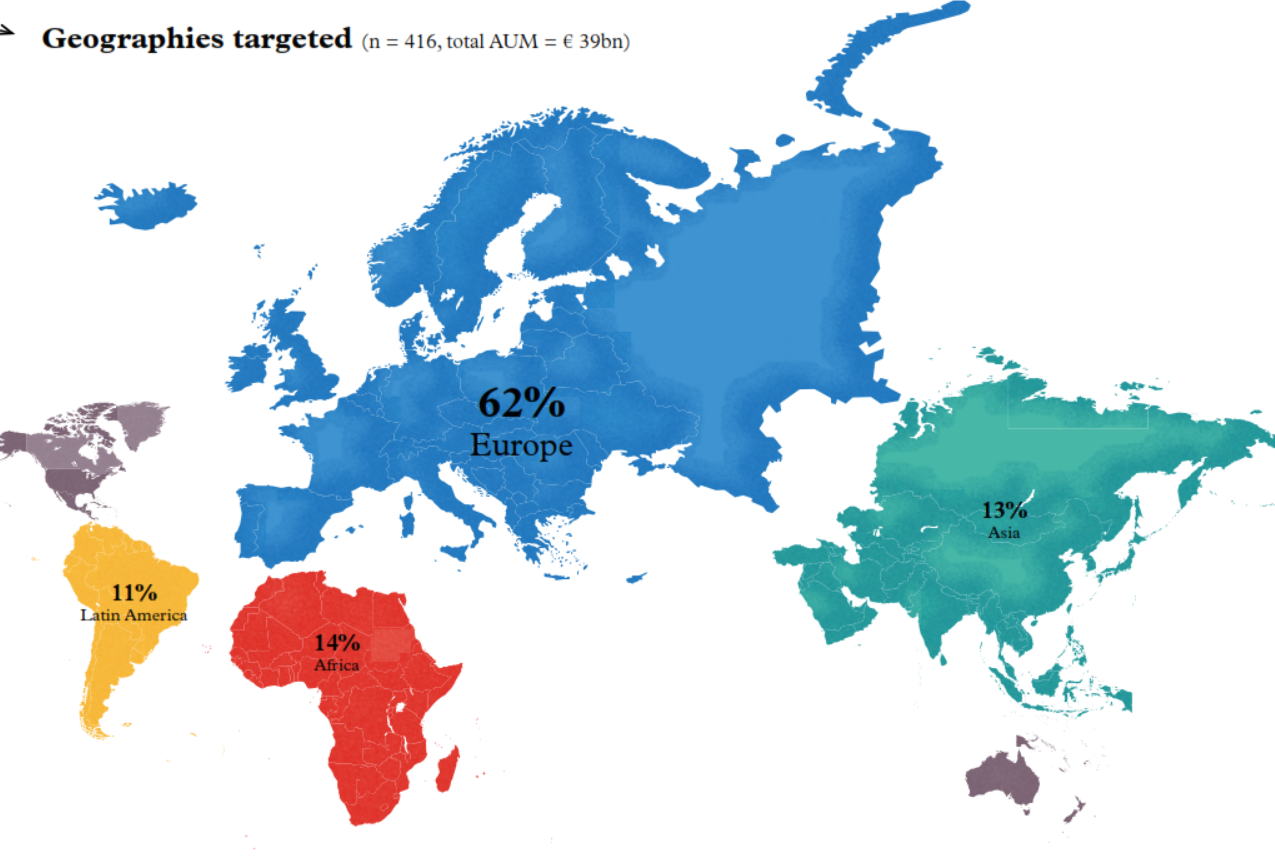

4. 40% of the investment is allocated outside Europe

Although the report focuses on investments by European entities, almost 40% is allocated outside Europe. These external investments are evenly divided between Latin America, Africa, and Asia.

Of the investments made within European territory, most are invested in the countries of the investing entities themselves. However, 16% of the investments have been made in other European countries, a figure that, compared to the last EVPA study, shows how European investors are increasingly inclined to invest in neighbouring countries, probably due to more favourable regulatory changes.

You can download the full report at the following link.