EFC Uganda Limited (MDI) est une institution de dépôt de microfinance agréée en Ouganda. Elle a été créé en 2011 par Développement Desjardins International pour fournir un accès aux services financiers au segment de marché mal desservi des PME. La société opère à Kampala avec un siège social, deux succursales et cinq centres de services aux entreprises. EFC Ouganda est supervisée par la Banque d'Ouganda et compte plusieurs actionnaires réputés.

Shem Kakembo est le directeur général depuis début 2018. Avant de rejoindre EFC Uganda, Shem a occupé des postes de direction dans l'industrie financière en Ouganda et au Rwanda depuis 2003. Le dernier poste qu'il a exercé avant de rejoindre EFC était celui de responsable des marchés personnels (détail) à la Stanbic Bank (la plus grande banque ougandaise).

Information Générale

| Emprunteur | SOKO INC |

| Pays | Kenya |

| Siège social | San Francisco |

| Website | https://shopsoko.com/ |

| Financé | 15 Mai 2012 |

| Actif sur Lendahand depuis | 19 Septembre 2019 |

Informations financières au 2020-12-31

| Total des actifs | €7 289 938 |

| Revenus | €742 081 |

| Ratio de levier | -34,00% |

| Liquidités | 129,00% |

A propos de Kenya

Le Nicaragua est le plus grand pays de l'isthme d'Amérique centrale, bordé par le Honduras au nord-ouest, les Caraïbes à l'est, le Costa Rica au sud et l'océan Pacifique au sud-ouest. Managua est la capitale et la plus grande ville du pays. C'est également la troisième plus grande ville d'Amérique centrale, derrière Tegucigalpa et Guatemala. La population multiethnique de six millions d'habitants comprend des personnes d'origine indigène, européenne, africaine et asiatique. La langue principale est l'espagnol. Les tribus indigènes de la Côte des Moustiques parlent leurs propres langues ainsi que la langue anglaise. La diversité biologique, le climat tropical chaud et les volcans actifs font du Nicaragua une destination touristique de plus en plus populaire.

Dernier projet financé

Soko Inc. 6

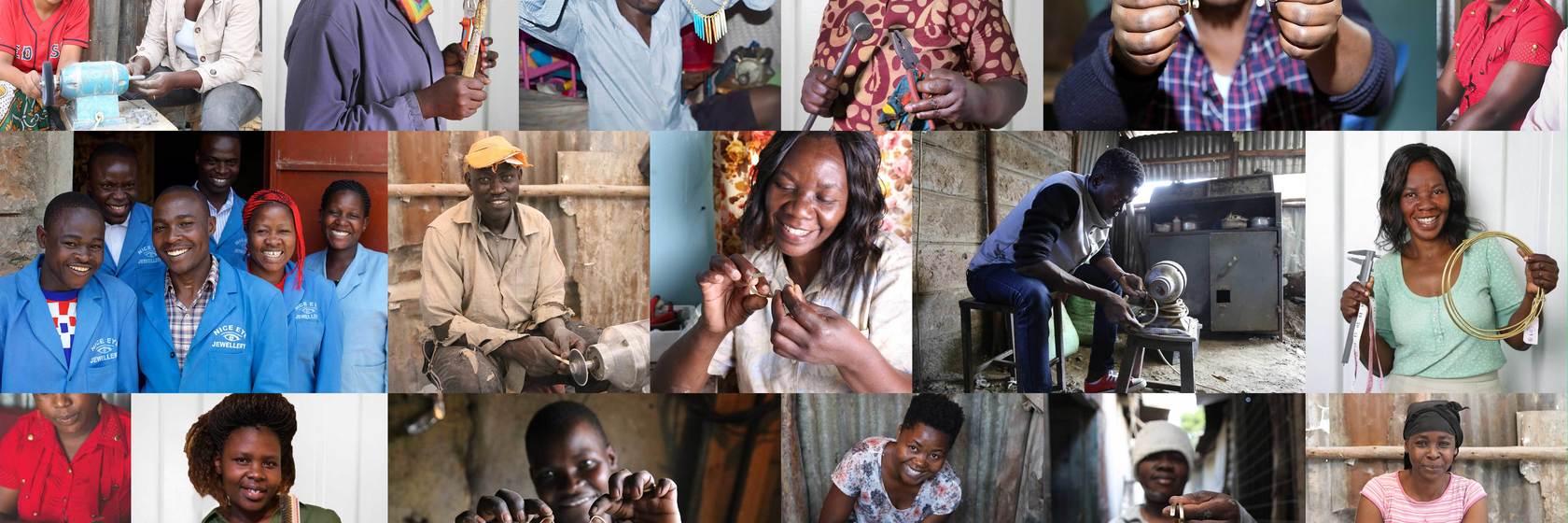

With EUR 165,650 B-Corp SOKO will be able to procure ethically sourced products from 2,300 Kenyan artisans (project only available for tax-residents in the Netherlands).